FAQs on Pension Services

Home Pension Services FAQs on Pension Services

If you cannot find an answer to your question please contact us.

Medical / Travel Claims

Federal Public Service retirees who are under the Pension Scheme and Employees Provident Fund (EPF) retirees who retire for the following reasons:

- retire upon reaching the retirement age option;

- health reasons;

- when the position they held is abolished;

- for the purpose of facilitating the re-organisation of the department or organisation where the officer works for ease of improvement;

- termination for reasons of public interest; or

- death in service

Eligible family members who are husband or wife and children under 18 years old; or, if they are still studying, under 26 years old; or children who suffer disability due to brain or physical weakness as stipulated in the Pekeliling Perkhidmatan Sumber Manusia – Kemudahan Perubatan Versi 1.0(2022)(CERAIAN SR.2.1.1).

The regulations on the application of medical benefit expenses for pensioners and eligible dependants are subject to the Pekeliling Perkhidmatan Sumber Manusia – Kemudahan Perubatan Versi 1.0 (2022) (CERAIAN SR.2.1.2.). However, the application of this circular by Statutory Body and Local Authorities is subject to the acceptance of their respective authorities.

The reimbursement claims for kidney treatment expenses, as well as medications related to kidney disease, can be claimed from KWAP (subject to the prevailing effective policy).

Pensioners must receive treatment and medical supplies at any government hospital/clinic and must receive confirmation/approval from a government physician. Pensioners must then fill in the Medical Form 1/09 along with financial documents (treatment bills, receipt, invoice etc.) attached to the form.

Effective 1 January 2024, the applications for Dialysis Claims (Individual) for Federal Public Servant Pensioners and eligible dependants must be submitted to KWAP within the following month.

Please click the link for more information.

Hebahan-Berkaitan-Tuntutan-Kemudahan-Perubatan-Pesara.pdf (jpapencen.gov.my)

If any local physician confirms that the pensioner or his/her dependant needs to receive treatment from any physician at another place, then the pensioner can claim any allowance that he/she is eligible to as if the pensioner or his/her dependant is travelling for official duties.

It is hereby informed that, effective from 1 January 2024, the applications for Travel Claims (Outpatient Treatment & Government Party Witnesses) for Federal Public Servant Pensioners and eligible dependants must be submitted to KWAP before the 10th of the following month.

Please click the link for more information.

Hebahan-Berkaitan-Tuntutan-Kemudahan-Perubatan-Pesara.pdf (jpapencen.gov.my)

- General Order Chapter B

- Treasury Circular 3 Year 2003

- Treasury Circular 2 Year 2006

- Treasurt Circular Letter 8 Year 2010

PENSION MATTERS

A pensioner-to-be should ensure that the Department submits complete retirement documents to KWAP no less than 3 months before the retirement date to ensure that the retirement benefits could be paid in time

The pensioner should ensure that the last Department submits an updated service statement to KWAP for retirement benefits recalculation.

The service periods that shall not be taken into consideration are the service periods as a backup, contract, attachment, and temporary officer. This refers to Peraturan 7, Peraturan – Peraturan Pencen 1980.

The effective date of ASK retirement is one day after it is approved. Payment of the gratuity and Cash Award in Lieu of Leave (GCR), if any, will be made within 14 days from the retirement date, while the monthly pension will be paid within 21 days.

Family members / heirs / dependants of the deceased (demised officer) should contact the last Department and submit all the required documents to ensure the last Department is able to submit the derivative pension documents to Post-Service Division, PSD within 7 days from the date of death. Regarding the application for Funeral Arrangement Assistance (BMJ) of RM3,000, it should be claimed from the deceased’s last Department.

Family members/beneficiaries/dependants of the deceased (demised officer) should submit all the required documents to KWAP as soon as possible to ensure that the process of transferring the derivative pension to the eligible widow/widower/child/children can be done promptly. The Funeral Arrangement Assistance (BMJ) of RM3,000 is also eligible to be paid upon the death of a pensioner (effective 15 October 2010).

Pension recipients who further their studies to the first-degree level should fill up the Pengesahan Anak Belajar di Institusi Pengajian Tinggi (IPT) – JPA.BP.SPT.B03a form and submit it to KWAP for information updating.

The widow/widower/child/children from marriage after retirement is/are eligible to receive the derivative pension limited to the balance out of 20 years from the retirement date.

Pensioner’s spouse of a marriage occurring subsequent to the company’s privatisation is entitled to receive the derivative pension, but this entitlement is restricted to a maximum of 20 years from the date of privatization.

The member may switch to Scheme B within 2 years from the company’s privatisation date. However, they are not allowed to switch back to Scheme A. This refers to Pekeliling MyPPSM Ceraian UP1.5.1.

For couples who got married while in the service, their children’s entitlements are until 21 years of age or marriage, whichever comes first, or until graduation at the first-degree level.

The pension documents can be sent to:

Retirement Fund (Incorporated)

Pension Services Department,

Level 2, Skytech Tower 2,

MKN Embassy Techzone,

Jalan Teknokrat 2, Cyber 4,

63000 Cyberjaya, Selangor.

The application form can be downloaded at www.jpapencen.gov.my. or at the link https://www.jpapencen.gov.my/borang/bmj/Borang_BMJ-BM-2023.pdf. and further information on BMJ is available at the link http://www.jpapencen.gov.my/bmj.html.

Browse www.jpapencen.gov.my. and “Like” our Facebook, i.e., Post-Service Division.

You may get a replacement pension card at the counter at KWAP Cyberjaya or JPA4U Counter at Block C2, PSD.

The BMJ application must be submitted within 12 months from the date of the pensioner’s death.

You may call 03-88878777 or e-mail mypesara@kwap.okie.my.

In the case of death of a pensioner or pension recipient and no one is eligible for the Derivative Pension, the next of kin should take the following actions:

- Inform Pension Division (PD), PSD immediately about the death of the pensioner or pension recipient and furnish:

- 1 copy of the death certificate;

- Original Pension Card;

- Uncashed warrants, if applicable.

- PD, PSD will manage the balance of pension (if any), and payment will be made to the closest next of kin. The next of kin must present 1 copy of his/her ID Card.

Visit http://www.jpapencen.gov.my/ and “Like” our Facebook, i.e., Bahagian Pencen JPA and KWAP Malaysia.

Gantian Cuti Rehat

Cash Award in Lieu of Leave is a cash award given to Public Service Members who did not have the opportunity to utilise all of their leaves due to exigency of the service.

The Cash Award in Lieu of Leave came into effect on 1 January 1974 through Service Circular Number 1/1974 and is only granted to Public Service Members who retire on or after 1 January 1974.

The GCR Award is given only to Permanent Members (including officers under probation) and Temporary Members in Public Service who retire under Pensions Act 1980.

The GCR Award is not given to officers who resigned or officers who were dismissed due to disciplinary action.

Leave accumulation for the purpose of Cash Award in Lieu of Leave is based on the provision of para 21(1) Pensions Regulations 1980, relevant Service Circulars and General Orders Chapter C.

The GCR formula is as follows:

1/30 × accumulated leave days (no. of days) × (last-drawn salary + * fixed allowances)

The fixed allowances are:

- Fixed Premier Post Allowance

- Fixed Housing Allowance (ITP)

- Fixed Entertainment Allowance (ITK)

- Fixed Public Service Allowance (ITKA)

Subject to a maximum of 150 days

Public Service Department (PSD) is responsible for approving and paying the Cash Award in Lieu of Leave to federal public service pensioners, while state public service, statutory body and local authority pensioners will be paid by the last Department they served.

The GCR payment will be made within 21 days from the officer’s retirement date.

The officer/employee may accumulate the maximum leaves during the final year of service according to his/her entitlement.

General Questions

For pension / derivative pension benefits for ATM pensioners, you may check the status of application at the Veteran Affairs Department at http://www.jhev.gov.my/ or at the following address:

Pension Division, Veteran Affairs Department

Tingkat 8, Bangunan TH Perdana 101

Jalan Sultan Ismail

50250 Kuala Lumpur

Tel.No: 03-2050 8000

You may check your housing loan balance directly with the Public Sector Home Financing Board (LPPSA) at their website https://www.lppsa.gov.my/v3/my/ or at the following address:

LPPSA

No 9, Ministry of Finance Complex, Persiaran Perdana

Precinct 2

Federal Government Administration Centre

62592 Putrajaya

or any housing financing agencies for pensioners (for housing financing other than LPPSA).

Pensioner is required to complete the Debt/No Debt Declaration Form on Part B (b) Home Loan Balance and submit it along with retirement documents to KWAP. Repayment of the housing loan is based on the deduction instruction letter issued by the housing financing agency to the Pension Division. Pensioner may also refer to his/her respective housing financing agencies regarding the issuance of the deduction instruction letter.

Notification of a change of address can be made at the PD counter, via mail or through PD’s website at http://apps.jpapencen.gov.my/

**Change of address through the website will be done within one week from the date the application is received.

The Pension Card allows pensioners and their eligible dependants to obtain free treatment at government clinics/hospitals. It can also be used to get discounts for the purchase of Keretapi Tanah Melayu tickets. The list of eligible discounts for pensioners with the Pension Card can be obtained from the KPDNKK website.

The compulsory retirement age (reached the age of retirement) for members of public service is 55/56/58 or 60 years subject to the retirement age option selected by the member.

A member with pension who has reached the age of 40 years and has a reckonable period of service of no less than 10 years may apply for optional retirement by furnishing the document/application through the Head of Department where the member serves. The eligibility for retirement benefits is as follows:

- In the case of an officer appointed before 12.4.1991, the payment of gratuity and GCR will be made on the date of retirement, and the officer will be eligible for the pension payments upon reaching the age of 45 years for women / 50 years for men; and

- In the case of appointment after 12.4.1991, the payment of gratuity and GCR will be made on the date of retirement, while the monthly pension payment shall commence when the officer reaches the age of 55 years for both women and men.

The lowest pension amount for reckonable service of at least 25 years (300 months) is RM1000 effective from 1 January 2018.

The maximum pension amount is for the reckonable service period of 30 years or more (360 months). The formula for the maximum pension calculation is 3/5 or 60 percent of an officer’s/employee’s last-drawn salary.

Regarding the repayment claim for the purchase of ceremonial attire, please refer to the Ceremonial Division (Bahagian Istiadat) of the Prime Minister’s Department at the telephone number of 03-88726670 / 6672 or 038000 8000, MyGCC.

KWAP PESD, Cyberjaya

Retirement Fund (Incorporated)

Pension Services Department,

Level 2, Skytech Tower 2,

MKN Embassy Techzone,

Jalan Teknokrat 2, Cyber 4,

63000 Cyberjaya, Selangor.

Telephone: 03-8887 8777

E-mail: mypesara@kwap.okie.my/

PSD, Sabah Branch PD

Public Service Department Malaysia,

Post-Service Division Sabah Branch,

Level 1, Block A,

Federal Government Administration Complex Sabah,

Jalan UMS – Sulaman, Likas

P.O. Box 2061,

88450 Kota Kinabalu,

Sabah.

Tel: 088 488661 / 088 488662 / 088 488663

Fax: 088 488664 / 088 488665

PSD, Sarawak Branch PD

Public Service Department,

Post-Service Division Sarawak Branch,

Level 2, Marzuki Building, Lot 1656 Section 65,

Jalan Tun Dato’ Patinggi Hj. Abdul Rahman Yaakub, Petrajaya,

93050 Kuching, Sarawak

Tel: 082 241144 / 082 251818 / 082 252493 / 082-234981

Fax: 082 250126

1Pesara@DBKL Counter

1Pesara Counter

Kuala Lumpur City Hall (DBKL)

DBKL Tower 1

Jalan Raja Laut

50350 Kuala Lumpur.

Tel: 03-2617 9941/ 9944

Mother of the deceased officer/employee is not eligible to receive derivative pension. However, she is still eligible to receive derivative gratuity, Cash Award in Lieu of Leave (GCR)and derivative Ex-Gratia after the death of the officer/employee. In addition, consideration for Ex-Gratia Death benefits may also be possible.

No. There will be no deduction whatsoever from the retirement gratuity for any claim or expense incurred by a public employee while in the service.

Not true. All civil servants are entitled to pension subject to the conditions of permanent employment, confirmed post, conferred with the Pensionable Status (PTB) and retirement in accordance with pensions law.

No pension benefits shall be given to the officers who resigned or who were dismissed. Previous service can only be taken into consideration and combined for officers who are reappointed to permanent posts after 2012.

Payment Matters

Pension Payment Matters

Application to change the bank account can be made by completing the Permohonan Pertukaran Akaun Bank form (JPA.BP.PAB.01 Pin 2024), which can be downloaded from www.jpapencen.gov.my.

However, change of bank account is only allowed once within a 12-month period.

Complete documents can be mailed to the following address:

Kumpulan Wang Persaraan (Diperbadankan) (KWAP)

Jabatan Perkhidmatan Persaraan

Aras 11, Skytech Tower 2, MKN Embassy Techzone

Jalan Teknokrat 2, Cyber 4

63000 Cyberjaya,

Selangor

or;

Submitted via KWAP’s feedback web portal at the link https://feedbacks.kwap.my/

or;

Submitted via email to mypesara@kwap.okie.my

or;

Walk-in to customer service counter at KWAP Cyberjaya

Application must be accompanied by a copy of the bank statement or complete bank account information.

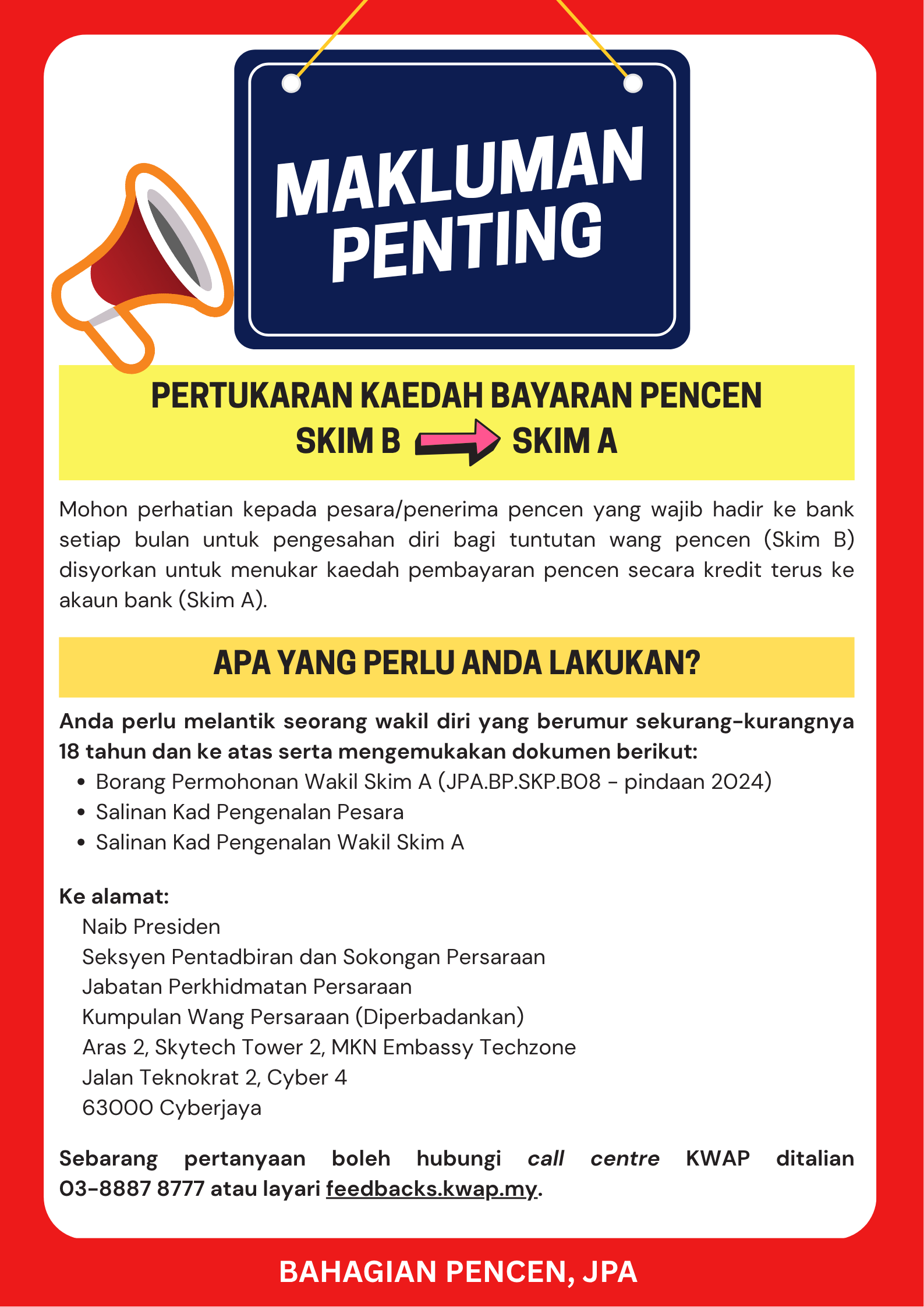

- Scheme A

- Pension payments will be automatically credited into the pensioner or pension recipient’s bank account on monthly basis.

- Scheme B

- Pensioners or pension recipients are required to be present at the bank counter for verification purposes before the pension is credited to the bank account.

- If the pension payments are not claimed for three (3) consecutive months, the payment will expire, and pension payments for the following month will cease. Pensioners or pension recipients are required to provide feedback to KWAP in order for the pension to resume.

If the pension payments under Scheme B are not claimed for 3 consecutive months, those payments will expire and the pension payment will cease in the following month. Pensioners need to report to KWAP to reactivate the account in order to resume the pension payments.

Yes, provided that the appointment of the representative is approved by the Post-Service Division. This representative appointment is granted to pensioners who are invalid and have a joint account. The representative must be a joint account holder with the pensioner / pension recipient.

Application may be made by filling out the JPA.BP.SKP.B08 – Permohonan Pelantikan Wakil Skim A (Application to Appoint a Representative for Scheme A) form, with a copy of the representative’s identity card attached.

Application may be made by completing the Funeral Arrangement Assistance form at https://www.jpapencen.gov.my/borang/bmj/Borang_BMJ-BM-2023.pdf

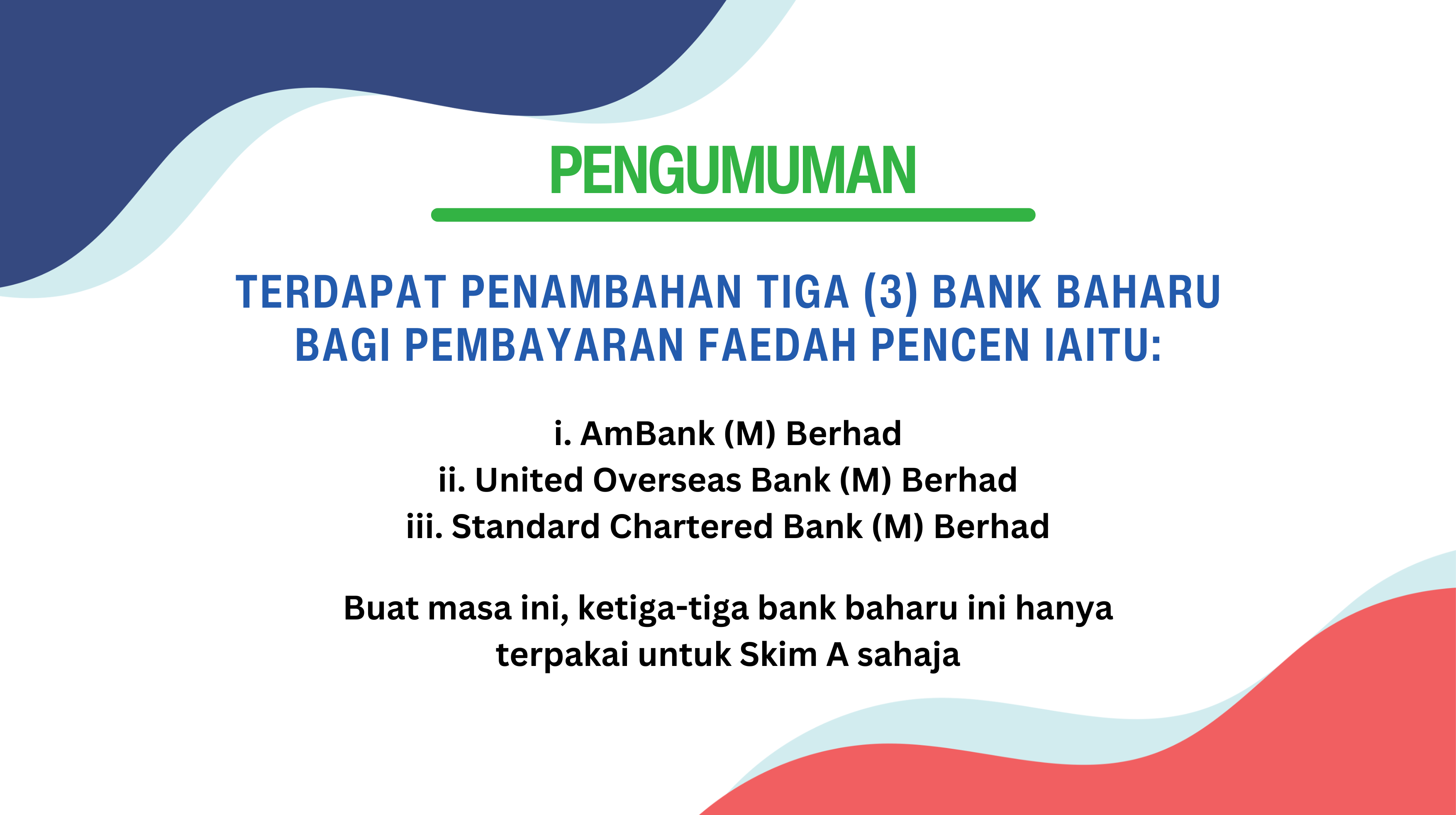

- Affin Bank Berhad

- Agrobank Berhad

- Alliance Bank Berhad

- AmBank Malaysia Berhad

- Bank Islam Malaysia Berhad

- Bank Kerjasama Rakyat Malaysia Berhad

- Bank Muamalat Malaysia Berhad

- Bank Simpanan Nasional

- CIMB Bank Berhad

- Hong Leong Bank Berhad

- HSBC Bank Malaysia Berhad

- Maybank Berhad

- Public Bank Berhad

- RHB Bank Berhad

- Standard Chartered Bank Malaysia Berhad

- United Overseas Bank (UOB) Malaysia Berhad

Pension payment via AmBank, Standard Chartered and UOB is strictly for Scheme A only.

Scheme A is the method of paying the monthly pensions to pensioners / pension recipients by crediting directly into the bank account of the pensioners / pension recipients (Scheme A).

Scheme B is the method where pensioners / pension recipients need to go to the bank every month to fill in the form in order to get the money credited into their respective accounts.

The utilisation of a joint account is allowed for pensioners or pension recipients from the following categories:

- Senior citizens (aged 70 and above)

- Pensioner/ pension recipientwith disabilities (OKU)

- Minor children (aged below 12 years)

- Pensioner/ pension recipient with health issues and aged below 70 years (Requires confirmation from a medical officer)

Appointment of a representative is required for the utilisation of a joint account. The representative must be the joint account holder of the pensioner or pension recipient

Application must be accompanied by a copy of Pelantikan Wakil Skim A form, which can be downloaded from www.jpapencen.gov.my.

Ex-Gratia Payment

Ex-Gratia Payment Upon Death is a grant provided by the government to the beneficiaries of the officer as an additional benefit to existing benefits.

It is granted to the beneficiaries of a public servant who died in service with a service period not exceeding 240 months, in addition to the existing benefits.

Ex-Gratia Payment Upon Death is granted to widows/widowers/children/parents of public servants who died in service, with a service period not exceeding 240 months and not due to suicide. Eligible service categories include temporary or permanent officers who opt for the Pension Scheme or the Employees Provident Fund (EPF) Scheme, serving in the Federal Public Service, State Service, Statutory Authority and Local Authority.

The amount is based on the duration of reckonable service, as follows:

| Service Duration (Months) | Ex-Gratia Payment (RM) |

|---|---|

| ≤ 60 | 150,000 |

| 61 to 120 | 100,000 |

| 121 to 180 | 75,000 |

| 181 to 240 | 50,000 |

Payment is made in one lump sum to the eligible heir.

No. The Ex-Gratia Payment Upon Death is additional to the existing pension benefits.

The Ex-Gratia Payment Upon Death for civil servants who opted for the pension scheme will be processed simultaneously with the application for derivative pension benefits. For civil servants who opted for the EPF Scheme, an application should be submitted by the Head of Department to the Post-Service Division, Public Service Department. The application procedure and relevant form are detailed in Service Circular Number 11 Year 2019.

Pension Adjustment

Pension Adjustment SSPA

Yes, the pensioner’s final salary will be adjusted in line with the actual salary of civil servants currently in service, known as the equivalent final salary. The new pension will be calculated based on the pension formula using this equivalent final salary. The percentage increase for the final salary is as follows:

Phase 1

- Top Management Group: 4%

- Executive and Management, and Professional Group:

Final Salary > RM3000: 8%

Final Salary < RM3000: RM240

Phase 2

- Top Management Group: 3%

- Executive and Management, and Professional Group: 7%

STEP 1

Calculation of the equivalent final salary for 2024 must be done first.

The method to obtain the equivalent final salary is as follows:

Executive and Management & Professional Group:

- Final Salary/Equivalent + (Final Salary/Equivalent × 8%) if the amount of Final Salary/Equivalent exceeds RM3000; or

- Final Salary/Equivalent + RM240, if the Final Salary/Equivalent is less than RM3,000

Top Management Group:

Final Salary/Equivalent + (Final Salary/Equivalent × 4%)

STEP 2

Calculation of pension based on the final salary (Step 1) to determine the new pension amount starting December 2024 is based on the following formula:

[1/600 ×Equivalent Final Salary 2024 X length of service*] + PKKP**

Note:

*If the length of service exceeds 30 years, the pension is subject to 3/5 or 60% of the equivalent final salary for 2024.

PKKP only applies to retirement on or before 31 December 2022 and is subject to Government decisions and policies from time to time.

The government agreed to extend the PKKP period from January to December 2025 through the budget announcement by the Prime Minister.

The new pension calculation can be done based on the published formula by entering the retirement details as follows, which can be obtained from the MyPesara mobile application:

- Equivalent final salary;

- Total quantifiable length of service; and

- Total PKKP amount received by the pensioner.

Retirement details and the new pension amount can be checked through the monthly pension statement in the MyPesara mobile application or the MyPencen web application for further reference.

The final salary for Pension Adjustment Phase 1 refers to the equivalent salary as of 2012 or the last drawn salary for officers retiring from 1 January 2013 to 1 December 2024.

Meanwhile, the final salary for Pension Adjustment Phase 2 refers to the equivalent salary as of 2024 or the last drawn salary for officers retiring from 2 December 2024 to 31 December 2025.

PKKP is a Government initiative to harmonise the implementation of the Federal Court’s decision while ensuring the welfare of pensioners.

PKKP represents the payment of the difference between the current pension amount and the original pension amount, ensuring that the amount received by pensioners each month is equal to the current pension amount.

Example:

If the original pension amount in December 2012 was RM1,413.49, and the pension amount in June 2023 was RM1,757.43, the PKKP calculation is as follows:

Original pension amount + PKKP special assistance = current amount

RM1,413.49 + RM343.94 = RM1,757.43

PKKP only applies to retirements on or before 31 December 2022 and is subject to Government decisions and policies from time to time.

The quantifiable length of service for retirement benefit calculation is taken from the date of permanent appointment up to the day before the retirement date.

Pensioners/pension recipients eligible for pension adjustment are those currently receiving:

- Pension Benefits

- Derivative Pension Benefits

- Disability Pension Benefits

- Dependent Pension Benefits

- Retirement Allowance Benefits

- Derivative Retirement Allowance Benefits

Will the new calculation also involve pensioners who have been retired for more than one year?

No, based on the Federal Court decision on 27 June 2023, there will be no annual pension increase. The next pension increase will only be implemented if there is a salary revision for civil servants.

Yes, the pension adjustment will be applied to all public service pensioners without any time limit.

Officers who retire between 2 December 2024 and 31 December 2025 are still eligible to receive Pension Adjustment Phase 2.

Pensioners/recipients who are not eligible for pension adjustment under SSPA are as follows:

PHASE 1

- Members of Parliament or Members of the Administration

- Political Secretaries

- Judges

- Pensionable officers who relinquished pension rights to join Statutory Bodies with Separate Remuneration (BBDS)

- Recipients of Dependent Pension/ Permanent Force Pension (POTPAT)

- Recipients of Ex-Gratia Work Disaster payments under 1PP: WP6.3 – Public Funds Management, Ex-Gratia Derivative PP 17/2008, and Ex-Gratia Lump Sum Death PP 11/2019 only

- Pensioners whose retirement date is on or after 2 December 2024

Pensioners and recipients who passed away on or before 30 November 2024

PHASE 2

- Members of Parliament or Members of the Administration

- Political Secretaries

- Judges

- Pensionable officers who relinquished pension rights to join Statutory Bodies with Separate Remuneration (BBDS)

- Recipients of Dependent Pension / Permanent Force Pension (POTPAT)

- Recipients of Ex-Gratia Work Disaster payments under 1PP: WP6.3 – Public Funds Management, Ex-Gratia Derivative PP 17/2008, and Ex-Gratia Lump Sum Death PP 11/2019 only